American Industrialization and China

Industry is not a jobs program

Wolf Tivy is a friend but I disagree with his thread here:

https://x.com/wolftivy/status/1946598085800653206

For those who don’t have access to X “formerly Twitter” here is an image gallery of his thread

This is a kind of argument usually called Sinophilic, maybe even an acute case of Sinophilia. But I think it makes certain wrong assumptions about Chinese success. Because these premises are shared not only by those who are impressed with China’s success but also by so-called trade hawks, economic nationalists in America, “industrial policy” and reindustrialization advocates and “postliberals” in the United States I wanted to write brief blog entry in hopes friends who know more will be inspired to write articles of their own. I’m not an economist and what I say here is based only on my peasant common-sense understanding.

China used to make crap, very basic mass produced goods. So long as they were the world’s cheap plastic souvenir and washing machine producer they weren’t a threat. This was true until very recently. There’s an old economic observation that you can only make so many fridges. But China seems to be led by intelligent and rational men who in fact don’t think as the thread above seems to believe. China didn’t and doesn’t actually want to be stuck building just iron pipes. In the last 10 and especially 5 years China made enormous progress in manufacturing technology, energy production, and automation. It’s trying to move up the production chain to higher-quality goods, and here has made great leaps very recently. In fact no smart country wants just to remain a manufacturer of toilets (designed by others) in order to “give good jobs to good communities.”

I see little awareness in most quarters of American and European “industrial policy” circles of recent Chinese advances. Intelligent countries don’t want to be stuck building just basic goods. If you watch this old speech by Lee Kuan Yew from 1980 you can see Singapore also didn’t think so: Lee Kuan Yew mentions Deng Xiaoping in this speech. At this time China was just abandoning communist economics in favor of something like the Singapore model, on Lee Kuan Yew’s advice. (I know Chinese still call their system “communism,” but everyone knows at least in economic terms it isn’t.)

I’ve criticized Chinese science before and I think in the actual hard sciences and pure mathematics they are still woefully backward and derivative. In economic terms at least in the short and medium term this doesn’t matter though. I remember when American mathematician friends would visit Japan even recently, after decades of Japanese modernization…the local scholars were awfully impressed not just by their achievements but even absurdly by their credentials from or positions at prestigious American universities: they were treated like gods. They found the local sciences to be uninteresting and backward. Nevertheless, Japan was until recently the second most powerful economy in the world, and the hard theoretical sciences and mathematics aside, they were and are leaders in industrial production and similar technology as well as in robotics and a few other fields.

Those bullish on China often like to post images of gleaming cities and public infrastructure there; I find this less impressive. Having lived for a long time in various parts of the Third World, it’s true that subways, airports, highway tunnels, etc., have long been more advanced even in places like Brazil than in the United States. The subway and malls in Rio are gleaming, safe, and I remember even ten or fifteen years ago the highway tunnels in south Brazil were equipped with the latest technology. I asked a local friend why and how they could do this when there were still slums on the hills and he responded, “That has no solution; it’s either genocide or you know, build really nice tunnels and forget the big problems.” Such places can be well ahead of what you can find in America in certain points of infrastructure and even public life, but in general Brazil is stagnant, and same holds for other places in the Third World. It’s a mistake to focus on this as evidence of a more advanced economy as such. The recent advances China has made in industrial production and technology, however, are very different.

There is widespread ignorance on the current state of American industry and manufacturing technology relative to China. Industry in the United States is hollowed out and backward. Why is this? It’s not so easy to put it under one word or concept. Environmental regulations aren’t bad: in fact the words of these regulations are quite reasonable. But they’re enforced by fanatical, stupid or malicious bureaucrats who interpret them in a way that makes building of new factories basically illegal or too costly in most of the United States, especially in places like California where the human capital and other conditions exist for very modern factories to be built. This is why it would be less costly to build factories in China or Vietnam even if you raised tariffs 300%…aside from these regulations, the introduction of advanced manufacturing technology and automation is prohibited by union regulations in most of America.

You can put all up all the tariffs you want, but until you change these kinds of things, you won’t actually have any kind of reindustrialization that matters. The extension and corruption of environmentalist norms, with which I fundamentally otherwise agree, but which now in warped form tyrannize over the American economy is a subspecies of a bigger problem, the moral fanaticism and purity tests that go a long way to explain the rot at the core of America’s functions. It’s been obvious for a while for example that oil and coal are “icky” in an aesthetic, sociological and maybe moral sense to a large section of American polite society, so during Democrat administrations the United States cuts off its own knees in those fields. But it’s not just Democrat things: manufacturing as such violates America’s new moral sense regarding labor fairness and environmentalism, so it gets shipped off to China; energy in general as well, so off to China; America had the world’s leading rare earths mining, and it got closed and shipped off to China, with the public justification being environmental. Ditto, drones, which the FAA regulates and puts on hold to study for 15 years for noise and such, while China ends up owning the industry. America had a great vapes industry, and was on its way to high-quality vapes free of toxic substances, but it got legislated out of existence so now it imports sketchy vapes from China. And so on. What is all this? It has little to do with tariffs or trade. It’s unclear what “these things” are. “These kinds of things” consist in part of an atmosphere of moral purity tests and taboos, in part of a selection of “elite” classes that are susceptible to such: but it has to do with human decision, mindset, and culture.

It’s possible that America’s problem is fundamentally one of how it educates and selects its elites, a point I’ve made again and again over many years. Heritage American companies like Boeing or Intel are currently moribund: they produce crap goods based on outdated and deficient technology; they are “rent seeking” on existing intellectual property and have fallen very much behind. This is a separate problem, and caused by various kinds of deep rot within American society, economy, and hiring practices. Even with a consumption-based GDP and financialized economy America is just so rich that incredible things could be done: in biology, medicine, bioengineering for example, but if you look at the grants at top universities they assign something like 80-90% to HIV research. What do you call that? It’s not a centralized decision by the way, but the result is bleak. It’s a huge misallocation of wealth, where in fact if it was different, even just a few discoveries otherwise made with that funding could result in multi-billion dollar businesses and products. In a serious society deserving projects would get that funding: not bottomless HIV funding for moral reasons. In a rich society malinvestment is inevitable, but in America the good projects and core functions don’t end up getting funded. Scientific research investment, the grant process, etc. is all subject to the same types of bad decisions, born of moralistic fixations. I don’t know that the solution here is to insist on building lead pipes in wholesome factories again.

In all this debate, the poor quality of America’s “elite” or managerial class, which is unserious and self-righteous, is maybe the biggest weakness, and it’s again hard to decide if this is a cultural, social, economic or political problem. But populists have no idea how to solve this; many engage in lurid fantasies of a hyper-competent Machiavellian or Nietzschean “eugenicist” “elite” that effortlessly steers all world events while blackmailing its members with kompromat involving child abuse or cannibalism. Even less colorful varieties converge on versions of “Bill Gates the Nietzschean elite mastermind.” It’s a weird situation where both the libtard “elite” and populists are calling each other “Nietzschean.” Me and five anons on the internet bear the brunt of this completely fantastical discourse. The current ruling class or “elite” of America is indeed very inadequate, but not for reasons populists say.

None of these things by the way have anything to do with tariffs or trade policy. Boeing doesn’t make bad planes because of tariffs or trade policy. Unfortunately many trade hawks agree with the assumptions underlying much of this stagnation, namely that industry exists to give the common people good jobs rather than to produce high quality goods other people want to buy. American goods that are high quality in fact are bought with eagerness by foreigners. They don’t want to buy, e.g., American cars or planes because they’re bad quality products, not because of tariffs. (Similarly, “trade barriers” exist on many American agricultural products because they’re grown in frankly toxic conditions that are banned in other countries; other countries ban them not because they want to sabotage American farmers or simply to protect their own products, but because they don’t want to eat toxic food).

Aside from the desultory condition of its companies and products, America suffers from another non-trade-related problem: its unfortunate demographics at the middle and lower-middle levels too. The kinds of factories that could actually compete with Japan or China would need to be manned by men and women of a minimal intelligence and discipline that just doesn’t exist in an America of 2025 anymore in sufficient demographic weight. By this I mean that the United States now has frankly too many stupid blacks and hispanics who are unemployable and useless in a technological civilization. Postliberal fantasies of a “multiracial working class democracy” mobilized against financier fatcats will have a real world manifestation in dysfunctional industry and ramshackle factories that double as welfare and day care centers for adult children. This will produce nothing anyone wants to buy. They would only be kept open and subsidized as a jobs program, that is, as indirect welfare payments. But it is another reason America desperately needs the peoples of Europe and Japan, which still have a critical mass of smart enough men and women who can actually work these factories; and it is another reason not to antagonize or abuse them.

At the moment the most advanced manufacturing technology exists in Europe, specifically in Germany, and also in Japan. They arguably still have the edge on China. America can’t plausibly catch up to them in just a few years and needs their automation and other technology as well as decades-long acquired expertise to modernize its own industry and make it competitive against China. The African-American Elon himself, whatever his other faults, doubtless knows a lot about manufacturing technology, and he is very much against the tariffs. Tariffs aren’t as such either good or bad, and they could be used to great effect, but the particular tariffs suggested do nothing to encourage American manufacturing of high-level goods and may in fact make it more difficult (under the previously proposed tariffs, it would have always been cheaper to buy a Chinese drone than to design a better one in America).

There is in the United States among nationalist intellectuals widespread ignorance about the high level of many European industries: yes Airbus used to be called “scarebus,” but now it’s the leader in airline technology. It is Boeing that is moribund. As in many other cases, like the debate on birth rates, a lot of American nationalist opinion is based on outdated information. ASML and other European tech companies are leaders in their own fields as well and America needs them as much as they need America if there is going to be any plausible challenge to the prospect of Chinese hegemony over the next century.

In general, the hostility fostered lately between American and European nationalists is counterproductive and self-defeating. I agree with this recent thread that actually both America and Europe are declining powers with very serious problems.

They need each other (and Japan) desperately if they are to make it. China’s scale alone makes challenge unlikely and very difficult: leave alone stupid online projections about what the world or China will look like in 50 years based on current demographic trends (how many projections from 1975 or 1965 accurately predicted what the world would look like today?)—but even according to the worst projections China will still for the foreseeable future have hundreds of millions or a billion people of reasonable intelligence, full of hunger for material success and very hard-working. Europe, America, and Japan (and their extensions like Australia) can only challenge this market and population scale with extensive integration of their economies and technologies. They will either face the Chinese giant together or will become vassals or worse separately.

To speak of supposed American “subsidy” of e.g., Germany or Japan in this context, for which these must now be made to pay is for this reason very misguided. In fact these nations produce real high quality goods, which they send to America and in exchange they get paper currency; they also however buy American debt with that currency. Many defenders of these tariffs then mention America’s “protection” of Europe as the meaning of “subsidize”: in other words America subsidizes Europe, Japan and Korea with defense spending and military bases. And this is then supposed to justify tariffs as a form of tribute for protection. Quite aside from the resentment and hostility that open bullying engenders, I don’t think it’s really correct to speak of “protection” given to Germany and Japan especially. They were destroyed in World War Two and are in fundamental ways “conquered”; they are not allowed whether by their constitutions or new political “traditions,” imposed by America, to have their own militaries or to have nuclear weapons, although they likely should have these by now. I also think any notion of major or imminent threats these nations face is greatly exaggerated: protection from who? My friend Gen. William Odom used to say the purpose of NATO is to keep the Americans in, the Germans down and the Russians out—in that order. American presence in Germany is mostly defensible as benevolent on the reasoning that it reassures neighboring European nations they won’t be dominated or bullied by Germans, which prevents another internal European insecurity and arms race—so the argument at least goes. That ends up helping America as well…maybe people are unaware of this too, but American investment in Europe is still orders of magnitude greater than in Asia. But the amount of money America spends on “defense” of Europe is negligible and can’t count as substantial subsidy. Unfortunately both Europe and especially America spend vastly more on social welfare programs and transfer payments to nonworking populations than they do on anything military.

The thread by Wolf Tivy (who, it should be clear, I am not at all accusing of all the faults I talk here…I’m only using his thread as a point of inspiration) quoted at beginning of this blog entry makes another false assumption widespread among economic reformers in America: that financial markets are something bad or that financiers are bad as such. The claim is made that China somehow is above the grubby and pointless business of finance and pursues real, productive capitalism out of moral conviction, as opposed maybe to finance and “speculation” capitalism. But America’s control of financial markets and its holding of reserve currency status is the only thing it still has going for it. That this has contributed to distortions into the American economy is true, but scuttling this one area of undisputed American dominance won’t resolve those distortions and may lead to disaster. Any attempt to reindustrialize can only be made by leveraging this great power. I was surprised to see someone in this administration post a communique that America was reviewing the reserve currency status of the dollar. Go down that path if you want to see food riots. Trump in fact backed down on the tariffs proposed earlier this summer because he still follows movement in the bond market and prudently realized that it could lead to a fiscal crisis and mass capital flight out of America. And then it’s game over.

China doesn’t “look down” on finance. It’s true that China limits the salaries of bankers, but only because for now it sees more benefit in its smart young people moving into science and industry: this isn’t done out of moral or ideological opposition to finance capitalism. America has displayed in recent years the huge power it still has over so much of the world by threatening to cut nations off from financial markets. I think this was stupid, and an abuse: the recent sanctions on Russia were recognized as America abusing its position even by its friends and I believe further abuse threatens America’s enjoyment of this huge economic advantage. But abuse or not, it’s indisputable real power. In World War 2 the Swiss sent 700,000 men to highly fortified mountain bunkers and ordered them to fight to the death in case of German invasion. Germany could maybe have won that conflict but only at the cost of millions of its own men during a difficult multi-front war, so there was never any attempt. Swiss banks survived Nazi Germany’s physical threats, but America merely threatened to cut off these banks from financial markets…and so ended Swiss secret banking. (As an aside: one of the most cynical laws ever passed was the fraudulently-named FATCA, which has prevented middle and upper middle class Americans from getting bank accounts or income abroad; in fact “fatcats” and large corporations can easily get around this law, and it’s been mostly used against, e.g. an American woman married to a Swiss engineer who gets fined and faces jailtime for being late to report $70,000 of her late husband’s income. This is typical of most populist legislation in the West against “financiers.”) China would maybe like to eventually have this power for itself, but it’s not yet in a position to challenge America. It’s not abstaining from finance capitalism out of wholesome concern for its commons.

China is at the moment destroying Hong Kong, and what Hong Kong was for finance is moving to Dubai and other such places, but this isn’t undertaken by the Chinese out of any hostility to finance as such. It is seen as a necessary sacrifice to destroy an internal thorn political nuisance. The people of Hong Kong themselves are antagonistic to China and resent being dominated by those they consider outsiders or usurpers.

Finance capitalism is amenable to abuse and can lead to distortions but so can “productive capitalism”; in fact both can be good and necessary parts of working “capitalism.” I disagree with the kind of wholesome populist invective against finance and financiers because of all the parts of America’s “fake economy,” it is probably the least fake. Populist and leftist invective against for example high frequency trading is based on ignorance, as Scott Locklin has time and again shown. Huge swathes of America’s economy is makework jobs and indirect welfare to women and minorities, including entire fields like HR. Many other Americans work in bullshit jobs like “insurance management” that represent no economic need, demand or function, but rather a drain and also a waste of human potential. Finance and financiers are not this. There is no animus in China against “financiers” and “financial capitalism”; quite aside from the fact you need financing and investment to build modern factories, China would, again, one day maybe like to occupy the number one spot in financial markets including control over the supposedly fraudulent financial derivatives and other instruments that populists are so fond of scoffing at.

And I am very aware that the American economy can be made fun of and mocked as a producer primarily of porn and of fraudulent financial devices. Actually I’m one of the people who first made this joke, and “postliberal” intellectuals are as usual copying blog and forum entries from maybe fifteen years ago, made by me and my friends. Here’s what: it’s a joke and an exaggeration. That part seems to be forgotten. It doesn’t mean there isn’t a truth to it, but it does mean that simply sticking it to financiers isn’t going to magically bequeath upon a nation an advanced industrial base. There is as far as I can tell almost no thinking and no moves even in this administration, let alone among nationalist intellectuals, as to what it would take to transition America to having such an industrial base.

Peter Schiff likes to say that he started his independent brokerage house in the 1990’s, but by the mid 2000’s this would have been impossible. Regulations raised the cost of compliance, which makes it impossible for, e.g., small finance startups to arise. Similar regulations in other fields make it very hard to start interesting businesses and products in America, in finance or in the development of physical goods. These regulations were introduced with the bidding and advice of the large financial houses; it’s called regulatory capture and cynical “left populists” like Elizabeth Warren and Alexandra Cortes are its champions, in the same way the FDA is the champion of Big Pharma under cynical populist consumer protection pretenses. The lack of responsibility introduced by similar regulations in housing, along with the 2008 bailouts puts the lie to the idea that anything like free market capitalism existed in America or the West by the way. If free market capitalism existed, Santander, which had not made the same mistakes other banks did in the early 2000’s, would now be the biggest financial institution in the world after the other ones would have been liquidated. “Finance capitalism,” understood under this coloring, can look like something bad for sure, but it’s not the only or even the ultimate cause, and merely introducing actually often ineffective regulations against it won’t automatically result in the efflorescence of advanced industry in a nation.

What many populists and economic nationalists miss is that “produtive capitalism” can also be just as corrupt and stupid. Argentina is an example of a nation that had extensive industry, a huge working class, and a leading position in the world economy. After Peron it had high tariffs, a protectionist economy, and extremely strong regulations protecting workers and consumers from the depredations of “fatcat capitalists.” It had furthermore a body of theory widely embraced by its intelligentsia that criticized international finance capitalism. This empowered a class of labor leaders, organizers, professors and intellectuals who held “Bannonite” economic nationalist and protectionist views on steroids. I’ve known rich older Argentines who came with stories of the negotiations that were carried out after Peron’s ascent: labor leaders argued in front of the big capitalists and employers with guns on the table. What a populist dream! It also had, by the way, a 90% white population that from my experience was even in its middle class specimens educated, literate, and as far as modern standards go, refined. Nevertheless it was a quaint and stagnant backwater that by the time of Milei was competing not with the United States or Japan but with Venezuela.

It’s possible to have all the things economic nationalists and similar ask for, but to be a declining cesspool increasingly mired in poverty. Argentina’s most notable achievement by the 2010’s was to be the first country to have significant demographic emigration of young men because of feminist tyranny. It also had mass migration from neighboring poorer countries, whose citizens were invited as political clients against the “capitalist fatcats”…because, if devious Elite financiers are the problem, why not? I’ve covered these things in a different article. Brazil is a similar country with much local industry, protectionist policies, high tariffs, but with poverty and stagnation. You can have both; there’s no guarantee protectionism will make you be like Japan…Japan makes high quality products people want to buy, you see. But that’s the important part. That’s why Tokyo doesn’t look like Buenos Aires or Rio de Janeiro. Actually here the exception is very edifying: Brazil despite its many problems does have certain competitive industry and products: Embraer is an airplane company with excellent reputation. It would be very interesting for someone to write about why, despite all this, Embraer is severely limited in its efforts to scale up or expand to new industries; why it has to rely on others for machine tools and critical inputs. It has to do with Brazil’s brownified demographics and the moral-Marxoid decisions of its “elite,” which can hold back even a great company led by great and smart people. See also: the new USA.

The example of Embraer among many others shows that both Brazil and America actually have the potential still to be great countries, but not under a moral-social-political framework that holds back the eminent in favor of the exigencies of brownification.

The danger America and Europe face is not “collapse” but a fate like that of Argentina. It’s not a system-reset collapse out of which you can come out a “victor” (with no political positioning or plan—a real delusion of collapse enthusiasts); it’s more like an autoimmune disease, it creeps up on you, it’s gradual and at the daily level imperceptible, until you end up wheelchair-bound in a ramshackle run by people like the Kirchners inveighing against “financiers.” It doesn’t empower good people. “Productive capitalism” I suppose is good and in fact the point if you actually produce good things. Good things are, in economic terms, things people actually want to buy. These usually turn a profit, which isn’t a bad thing.

I’d think all of this is obvious, but apparently there are many “economic nationalists” who think that the purpose of industry is to subsidize factories Producing third-rate beige plastic toilet covers that no one wants to buy because it “provides a good standard of living for the workers and the Communities.” At least Peron had a good excuse: the Communist movement and ferment in Argentina in the 1930’s and early 1940’s was extremely powerful, a looming danger that would have produced in my opinion one of the most frightful and murderous instances of that wretched type. Peronism was at least arguably a successful last-ditch effort to avert the worst and defeat it with the less-bad. American “postliberal” intellectuals have no such excuse.

The middle classes in America aren’t being radicalized by leftist economic promises, they’re just impoverished and lacking in prospects of building wealth as a result of leftist redistributionist, anti-growth and antiwhite policies and the concurrent uselessness of the pre-Trump GOP exemplified in the pathetic Paul Ryan and Mitt Romney and that bunch. But the mental universe of the postliberal intellectual is populated by mostly half-truths and talking points and what I’d call lifestyle positioning as a result of “the discourse,” that is, opposition to the Paul Ryan, Jack Kemp, Reaganite and to a lesser extent neoconservative words from 1980-2015. Before Trump this “vibe,” because that’s all it is, was exemplified in Santorum as its political champion. Ross Douthat and Reihan Salam wrote a book about this in 2008 or 2009. There are also scores of repressed homosexuals in the DC “Catholic” political movement and Conservative Intellectual scene who embrace varieties of delusions like Distributism, and who unbeknownst to most Americans, have and will have outsized influence on American economic policy. It’s not really Trumpism, but something that saw its chance to piggyback on Trump. At the moment it has many other champions of different kinds. This is a type of Peronism-light, without the existential justifications that Peronism initially had. When it’s not motivated by petty intra-party disputes and wanting to stick it to admittedly craven and dumb Paul Ryan types, it’s motivated by its own stupid, sentimental and self-righteous images. These are hoary stock photos and manufactured memories about the salt of the earth working folk where the husband has a perfectly manicured beard at his factory job, a female beard at home tending to children, and all attending churches of the intellectual’s preferred denomination. Some may think purpose of industry is to have nostalgic Ellis Island Fraternity 1930’s reenactments, maybe current-day variation with an abuelita piously looking on with a giant wooden cross…but it isn’t the purpose of industry to flatter your nostalgia and sense of community. China didn’t get to where it is by thinking it is either. I exaggerate only slightly here. The point is that conceiving of industry as a means of worker welfare, or Building Communities, or anything else other than what industry is actually for won’t actually produce either prosperity or power for a nation. In face of China’s progress and America’s industrial decay, this is all just so frivolous.

China doesn’t think of industry as a jobs program and neither did America in the 19th Century: the supremacy of American industry, during a time actually of deflationary currency, was because American workers had access to the most advanced machine tools allowing them to be the most productive in the world and the makers of the highest quality goods people everywhere wanted to buy. To the extent protectionist policies should exist, they’re good because and when they foster that; protecting and subsidizing failing factories that make things no one especially wants to buy is a dead end. My concern regarding the tariffs proposed earlier this year as well as Trump’s recent success in forcing money out of allies is that these measures do nothing at all to prepare America for a transition to a modern industrial base.

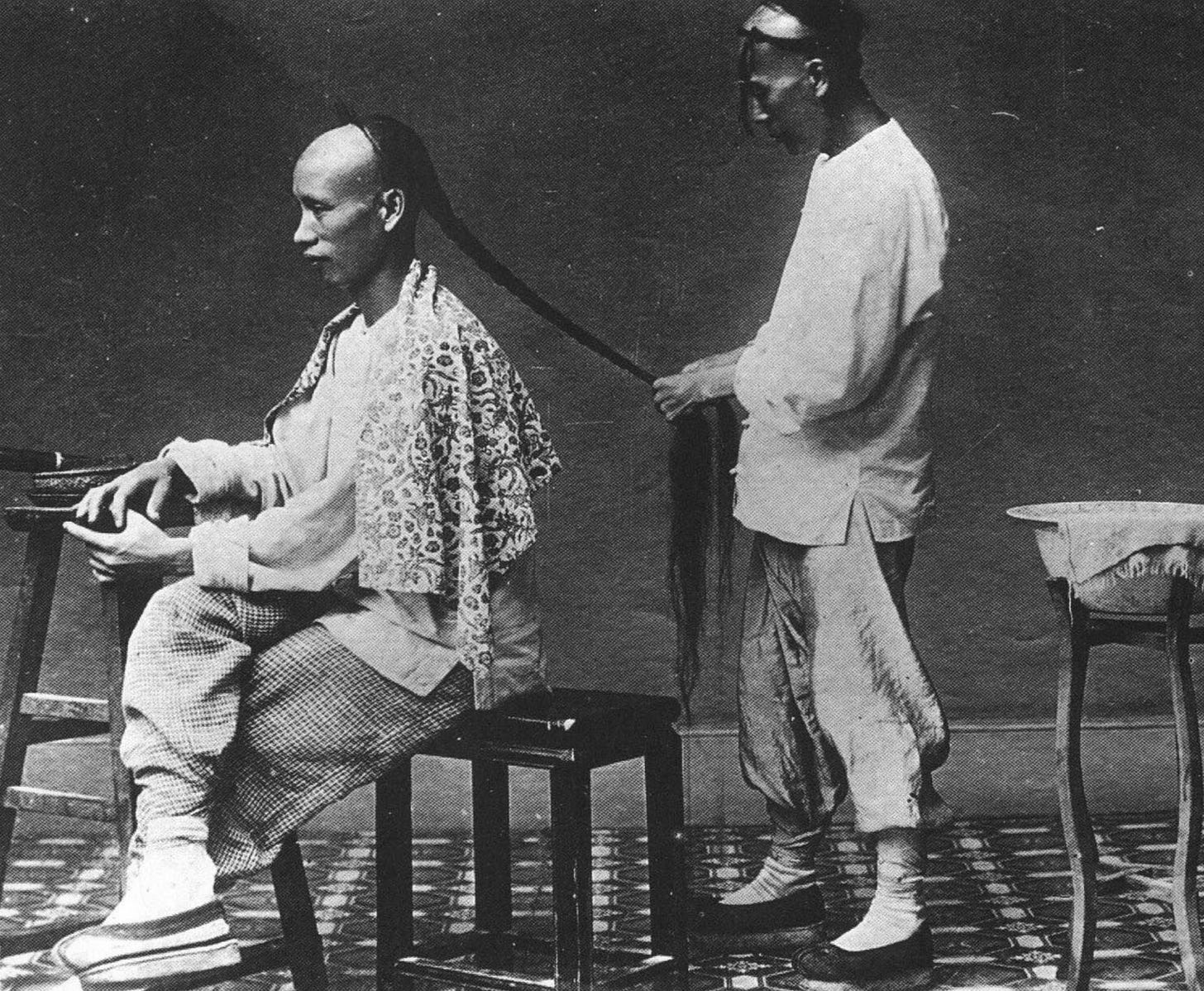

America has about five years, maybe ten years maximum to make radical changes. These would have to be, again, radical changes, more total and radical than what you can imagine at moment. And yet they would have to be done gradually and prudently, not with “shock therapy” and wild gambles. It would be a task more difficult maybe than even the immigration problem to solve, and would face greater resistance. To empower again excellence, and reward actual merit, to allow businesses to do this would be a bigger change to daily life and action than most can imagine now. Maybe…it might be too late. But it’s worth a try. Or get ready to have your kids be global second class citizens and be forced to wear the queue Manchu haircut. If you want to become acquainted with the meaning of this overused phrase now, humiliation ritual— let a resurgent China become world economic hegemon while its ruling class is motivated by historical grievances and a sense that it must avenge the 19th Century.

Haircut imposed by Chinese public aesthetic presentation for American youth, 2060

PS I need to add a postscript for dolts: neither in this, nor in criticism over the Iran attack—which I think was much less dangerous for the present and future of the country than ignorance of this policy—am I announcing a “break” or lack of support for Trump or his administration. I need to say this because every time anyone makes the slightest criticism there are howling porks on all sides who start to honk about teams, who is on team this or that, who “lost” what “influencer” and other such malicious gossip. I think Trump is the greatest man of our age, by far, and I think you’re blind if you don’t see that he alone is the driver of world events for the last ten years. He completely changed world events and the terms of the debate in ways that I never thought possible in 2015: there is no “populist movement” without him, and any such “movement” that pretends it existed before him is a pathetic lie. That doesn’t mean I need to agree on everything he does. It’s my impression that this administration is actually proceeding in general without a plan. What I propose here I do as a layman, with a layman and not an economist’s knowledge…and I ask friends who disagree to bring facts that contradict what I’m saying here, and ask other friends who know better than me to write their own more detailed articles on this. I felt I had to say this, motivated by my sincere belief that America is engaging in frivolities and doesn’t see the looming danger that will, unlike many current-day for-you-page fixations, actually determine what your and your children’s lives will be like for the next few decades in a very concrete, day to day sense.

Very balanced and sane view on finance and populist industrialism. Need to encourage new cohort of patriotic silicon valley hardware startups (ie. palmer et al.), especially wrt to underwriting venture financing from govt, like the chinese has done for solar and EV. Musk can and should be courted to be brought around with supervision of these programs

China does consider industry a jobs program - that’s precisely why they subsidize employment so heavily and are content to accumulate dollars in exchange for goods. In their mind, better to have an extra 5% of the population going to the factory to churn out widgets rather than collecting disability checks. The US, of course, has made the opposite decision.

That China-US mirror is perhaps the single key point your analysis misses: the US trade deficit (and its attendant joblessness) is the result, yes of overregulation, but also quite heavily of an overvalued currency. And it’s overvalued b/c China, the world’s surplus country, has a closed capital account. The US cannot forcibly open their capital account, the only solution is to make imports more expensive.

Countries running ~8% current account deficits as the US is now - at full employment, in peacetime! - are headed for a disastrous collapse, probably sooner rather than later. And because trade balances globally not bilaterally, we cannot simply target China - their surplus would find its way through intermediaries.

Tariffs are a clumsy, but effective stopgap solution.